I had some interesting conversations with a few people who considered watching business news channels and reading financial newspapers sufficient research for making investment decisions.

It’s very comforting to watch business new channels as some “expert” is confidently presenting a recommendation on a stock and sometimes even giving an intelligent sounding justification for the recommendation. I am not saying that getting another person’s perspective is necessarily a bad, but this cannot be the sole basis for making investment decisions.

Let’s look at the people who make these recommendations and their recommendations:

- They have interesting credentials – that makes them sound like experts, but no one tracks how their recommendations have fared over a period of time. Here is an article on the Jim Cramer’s predictions and one can google many such guru’s and see how their predictions fared (mostly below par).

- Most recommendations on TV are simple to understand and are black and white without much nuance. We are often impressed by a confident prediction giving a specific call to action, for instance “buy xyz at abc price and sell it when it goes up x%”. Let’s remember future is very uncertain – good predictions are able to present at a range of possible ways future may pan out. Over simplification handicaps any decent analysis. Over simplification goes against the maxim of – anything should be presented as simply as it can be but no simpler. Presenting analysis without any nuance makes it poor in information content.

- Good investment ideas are few and one should be wary that someone is just giving away ideas just like that. Legendary investors like Warren Buffett state that the good ideas are rare and refuse to discuss their active ideas. Most of us are wary when someone is giving out something valuable for nothing, very few of us question when someone seems to do this on a daily basis on business news channels.

- Most of the people on business channels state that they are not investing in their own recommendations – this should be a red flag. It is worth wondering why a person who claims to have a really good idea is broadcasting it but not putting his own money behind that idea.

Business channels tend to present investing as an adrenaline filled sport, this is understandable as these channels are in the business of maximizing their revenues which are driven by the number of viewers they are able to attract. It is in their interest to keep viewers excited and entertained. Whereas investors may be best served if they are kept informed and interested.

One is best served by ignoring the business channels. At best they can be treated as a source of information or ideas.

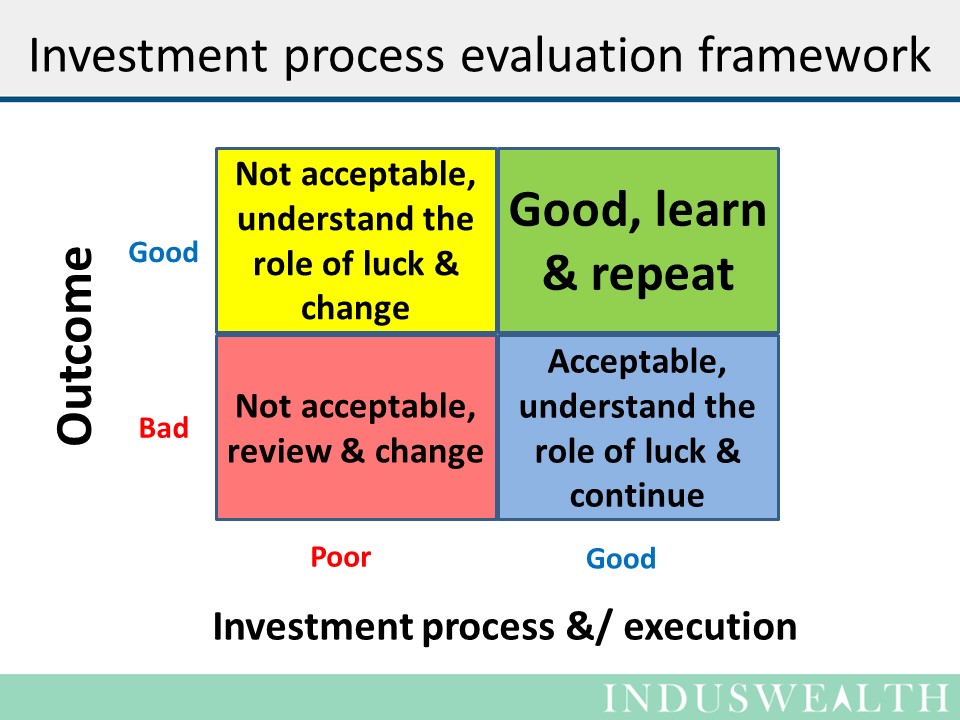

People who are interested in investing should dedicate time and effort to do their own analysis. This is relatively easy today with a lot of information available online. Investing is a probabilistic activity, it is best to evolve a process to invest and improve this process over a period of time. Measurement and feedback are key to successful investing. Here is a potentially useful framework to review investment process.

Pl remember- investing is simple but not easy and there are no perfect investors. Key is to be disciplined and to continuously learn & improve.

Happy investing …