Financial year 2014-15 has come to an end, and we are happy to share the results of IndusWealth portfolio:

FY 2014-15 had stated with a market P/E of 19 and moved up to 23 by end of March (higher than the usual average of 18).

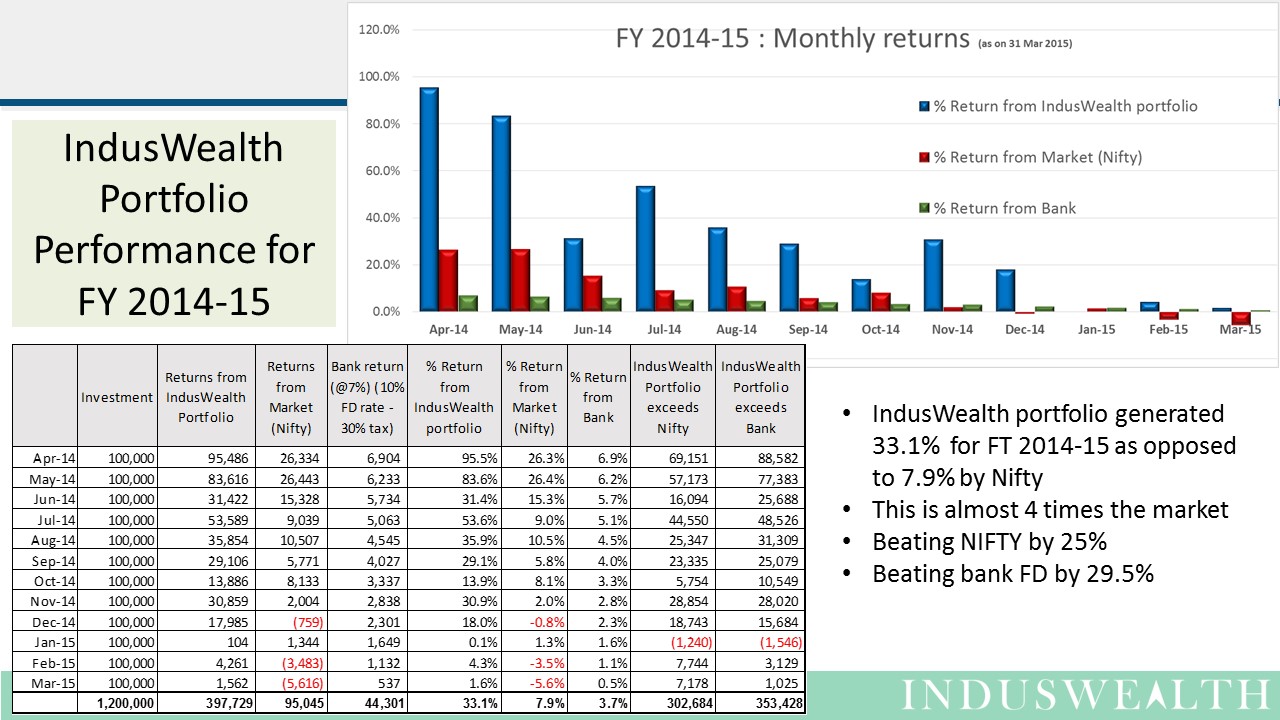

In FY 2014-15, if one were investing on a monthly basis in NIFTY the realized return would be 7.9%, IndusWealth portfolio returned 33.1% (67.5% annualized), beating NIFTY by 4 times.

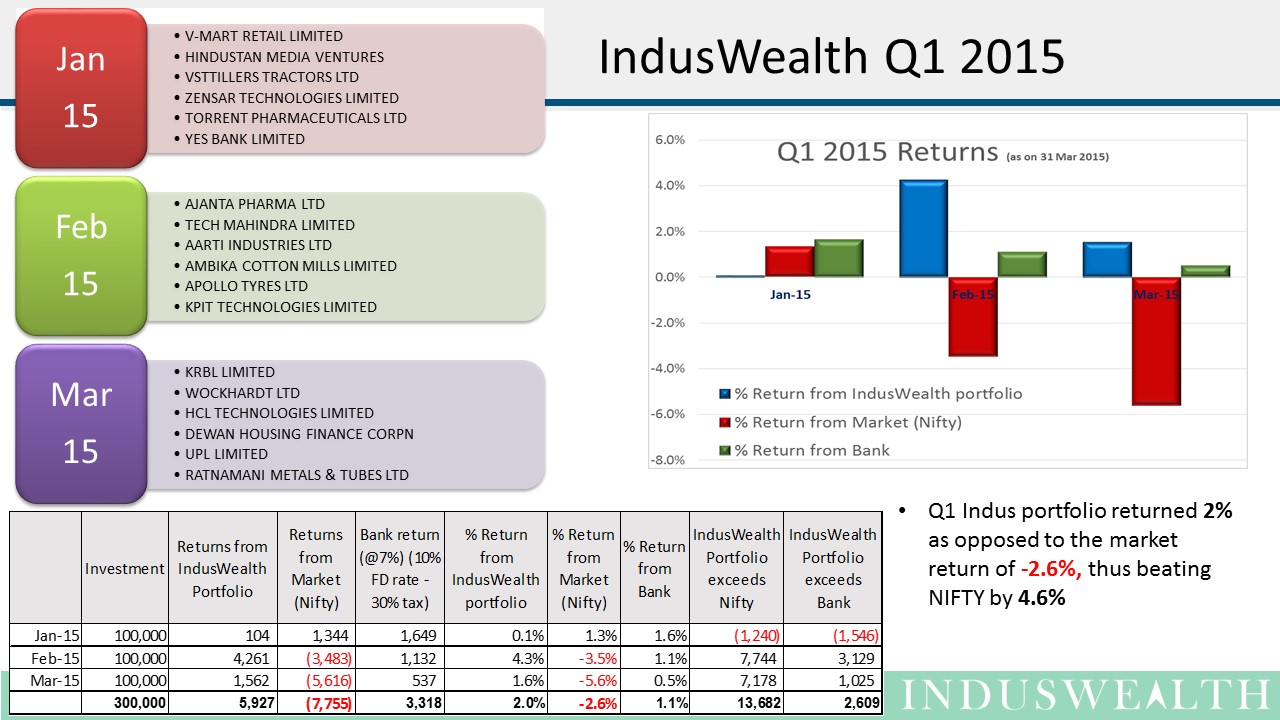

Q1 2015 (2015 Jan to Mar) was a period where the P/E were close to 24, we are glad that there has been a bit of correction in the market in the last couple of months.

High P/E markets typically generate lower returns. It is reasonable to expect the overall market P/E to move back to the long term average of 18. This could happen with an increase in earnings over a period of time, or with a sharp correction, or any permutation of these 2 scenarios. Trying to predict when and how this correction will happen will be a work of conjecture. We believe that long term investors will continue to do well with a disciplined investment approach. We published a white paper “Investment strategies for long term investors where the market P/E is high”, you can read it at the following link.

Results for IndusWealth FY 2014-15:

- Summary of the returns

- Transactions in the model portfolio

- Annualized returns for the model portfolio

- Performance against the benchmark for the model portfolio

FY 2014-15 has been a tough year to find good investments and finding prudent investment opportunities was a challenge. We expect this to continue in FY 2015-16. We believe we are up to the challenge to find prudent investment opportunities and will let you know if we are unable to do so.

We look forward to FY 2015-16 with cautious optimism. Our endeavour will be to continue with a “boring” investment approach, that generates “interesting” results and avoid any “excitement” what so ever.

Happy Investing…………….