We are the end of the second quarter in financial year 2015-16, and we are happy to share the results of IndusWealth portfolio.

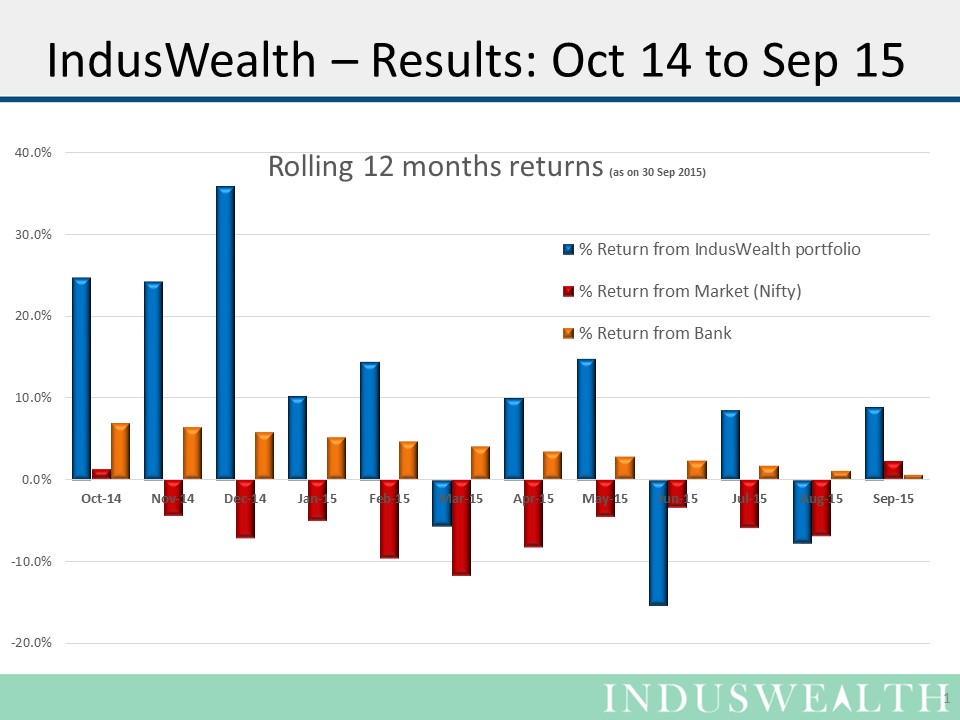

This is one of the most volatile quarters in the recent past. Movements of over 1% were not uncommon. In the last 12 months returns from NIFTY have been negative.

In last 12 months, if one were investing on a monthly basis in NIFTY one would have a loss of 5.3%, IndusWealth portfolio returned 10.2% (19.8% annualized). IndusWealth portfolio is beating bank fixed deposit return by 2.8 times.

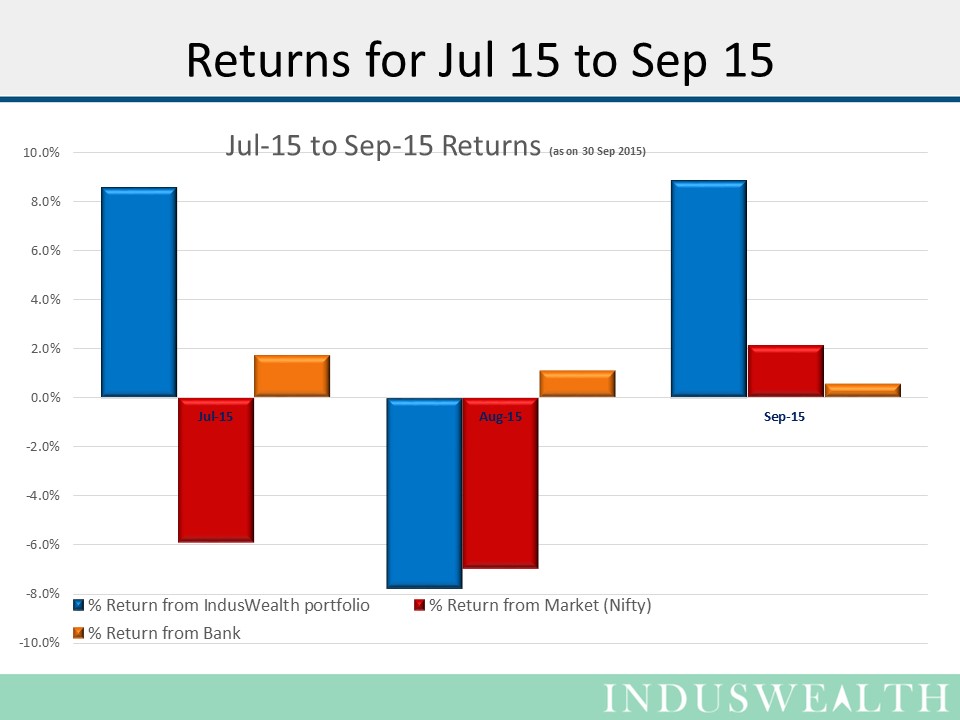

Q3 2015 (Jul-15 to Sep-15) Nifty lost about 3.6%. In this quarter, IndusWealth portfolio returned 3.2%.

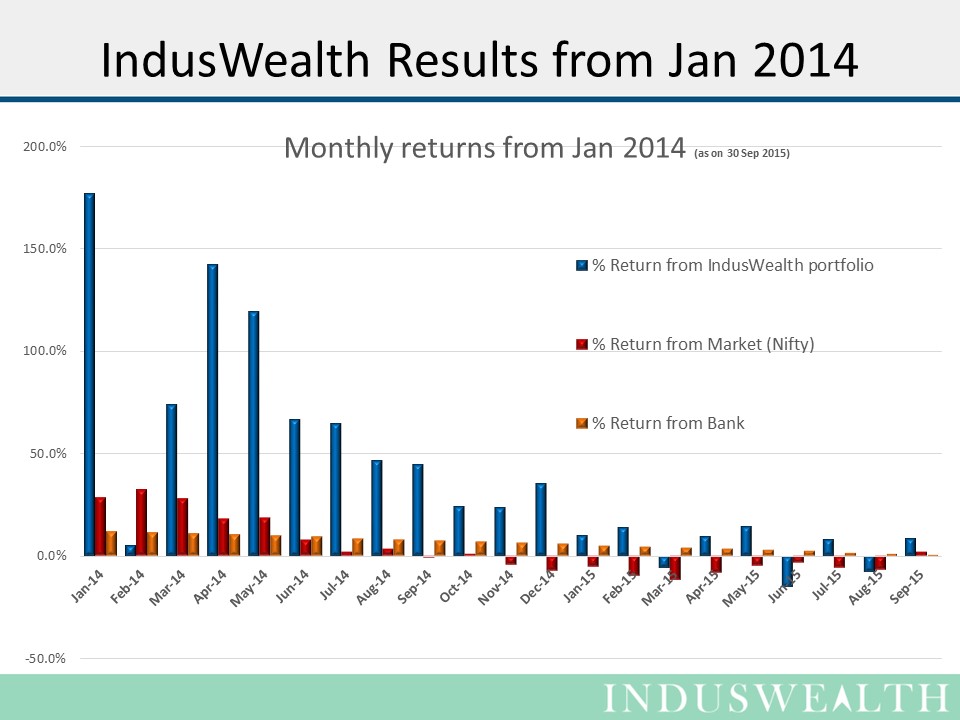

Since Jan 2014 – IndusWealth portfolio generated 41.2% returns (43.7% annualized) as opposed to 3.5% by Nifty. This is 11.7 times the market. Beating NIFTY by 37.7%. IndusWealth return is 6.6 times the bank FD returns. Beating Bank FD by 34.9%.

This means, someone who is investing a 1 lakh a month since Jan 2014 in the IndusWealth portfolio would have gain of 8,65,000. The same funds in invested in NIFTY would have a gain of 74,000 or an opportunity loss of 7,91,000. If this money was invested in a Bank FD it would have a gain (interest) of 1,31,500 or an opportunity loss of 7,34,000.

Results for IndusWealth can be downloaded from the links below:

- Summary of the returns

- Transactions in the model portfolio

- Stock wise returns for the model portfolio

- Performance against the benchmark for the model portfolio

This quarter, there has been some correction in the market, but earnings growth continues to be under pressure and the valuations are fairly high.

The long term story of India continues to be good. In 2000, India’s GDP was 0.5 trillion and now it is 2.3 trillion. In the same time frame China went from 1.2 trillion GDP to 11 trillion. India’s demography, aspirations of the people will be factors that will try and drive the nation towards development. There are going to be hurdles and setbacks but we believe that the direction will be north bound. For the economy to grow, industry has to do well and market capitalization tends to grow with the GDP. Investors with a long term horizon may want to take this long term perspective and treat short term fluctuations as noise.

We expect the markets to continue to be choppy but improve over a next 18 to 36 months. We reiterate that, this market is only for the people with long term horizon, as there could be significant volatility or long stretches of sideways movement in the market.

We believe that long term investors will continue to do well with a disciplined investment approach.