Managing taxes well will help us keep more of our money. We should realize that people who build wealth are aware of taxes and are able to leverage this knowledge to their advantage.

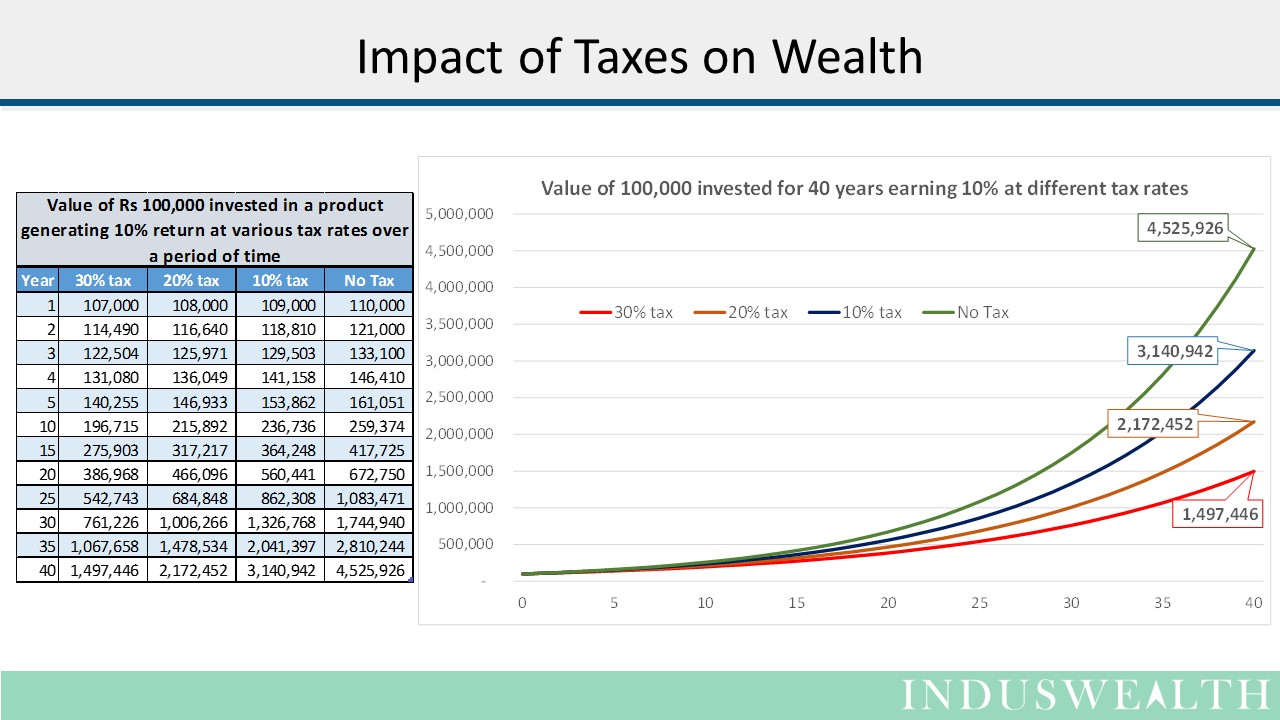

Let’s look at impact of taxes, if you are planning to save Rs 100,000 post tax and you are in the 30% tax bracket, you will have to earn 142,857 pre-tax, i.e., 42.8% more. Now let’s look at the impact over a period of time.

As you can see from the chart, Rs 100,000 invested at 10% interest for 40 years at zero tax becomes 4,525,926 and the same amount at 30% tax becomes 1,497,446. If you can avoid taxes you would be 3 times richer!!! As we can see the longer we invest, the greater is the difference.

Key here is to understand tax implications of various products. Governments typically encourage long-term investments and provide significant tax advantages for those who invest for long-term. In India if one invests in stocks for over one year then there is no long term capital gains tax!!!

This has 2 implications – let’s say a person is in a 30% tax bracket

- If she is looking at long term investment, tax advantage given to equities becomes a serious proposition for wealth creation. Equities generating 7% per year become more attractive than fixed deposits (FD’s) paying 9% interest as FD’s are taxable. So she finally is able to keep only 6.3% in FD as opposed to all 7% in equities. The magic of compounding will start to make the differences wider over a period of time. We should not forget that the dividends from equities also do not attract any taxes.

- If she is a trading often (even if she buys and sells a security with-in the same calendar year), then she has to earn 142,857 in profits to keep 100,000. Whereas if she is an investor, (holding the security for over a year!), then she needs to earn only 100,000 as she gets to keep all of it.

In summary, if you have funds that you can invest for a long term, then you should seriously consider investing in equities as the tax advantages for dividends and capital gains will help build wealth much faster.

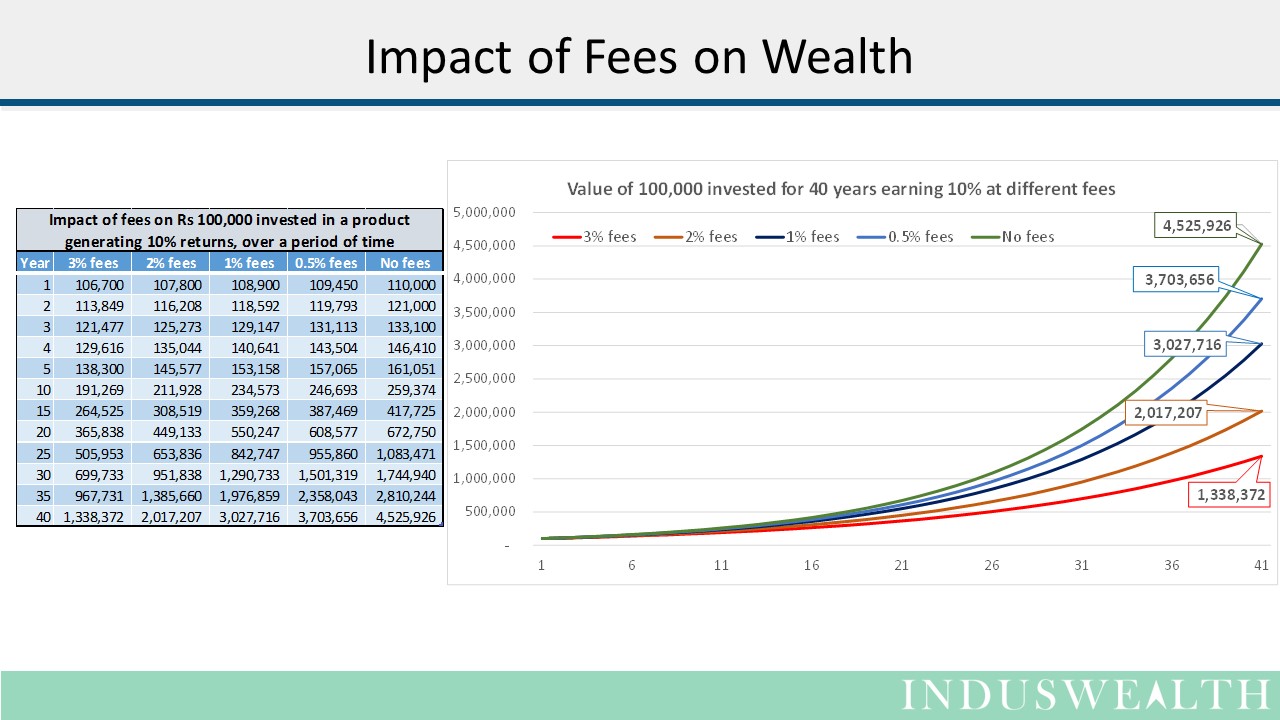

Most of us realize the impact of taxes because we explicitly pay taxes, but fees that are automatically deducted, especially by mutual funds, hence are not visible to us. Let’s examine their impact on our returns. Mutual funds charge between from 1.5% to 3% of the assets as the fees.

We can see from the above example that a 3% fee takes away a lot more than a 30% tax.

As you can see from the chart, Rs 100,000 invested at 10% interest for 40 years at zero fees becomes 4,525,926 and the same amount at 3% fees becomes 1,338,372 (it is even lower than 1,497,446 which is after 30% taxes). If you can avoid fees you would be 3.3 times richer!!! As we can see from the chart the lower the fee, the better is the return realized by the investor.

In this example we have assumed that the funds are making money every year, but the effect of fees will be more dramatic in the years when there is a loss. When there is a loss, the capital gets reduced further due to fees, thus reducing the return potential.

Taxes usually claim a part of the profits, but fees are a claim on the capital. Taxes are like taking a part of the crop when the crop is good. Fees, especially in the years where there is a loss, are like taking the seed from the farmer, this reduces what he has to sow, thus reducing the crop itself.

A more equitable way to pay the fund managers is to pay them for the returns they generate over an agreed benchmark. That way they are getting paid for the returns they generate over the benchmark and the investors only pay for the performance. You may want to read our article on paying the piper.

Fees and taxes are inevitable for an investor. Investors will be well served if they remember that taxes are assessed on the profits whereas fees are usually assessed on the capital.

- Prudent investors should look to minimize the taxes by choosing the right investment vehicles.

- They should actively work toward minimizing the fees. They should also make sure that the fees they pay is helping them get them a superior performance.